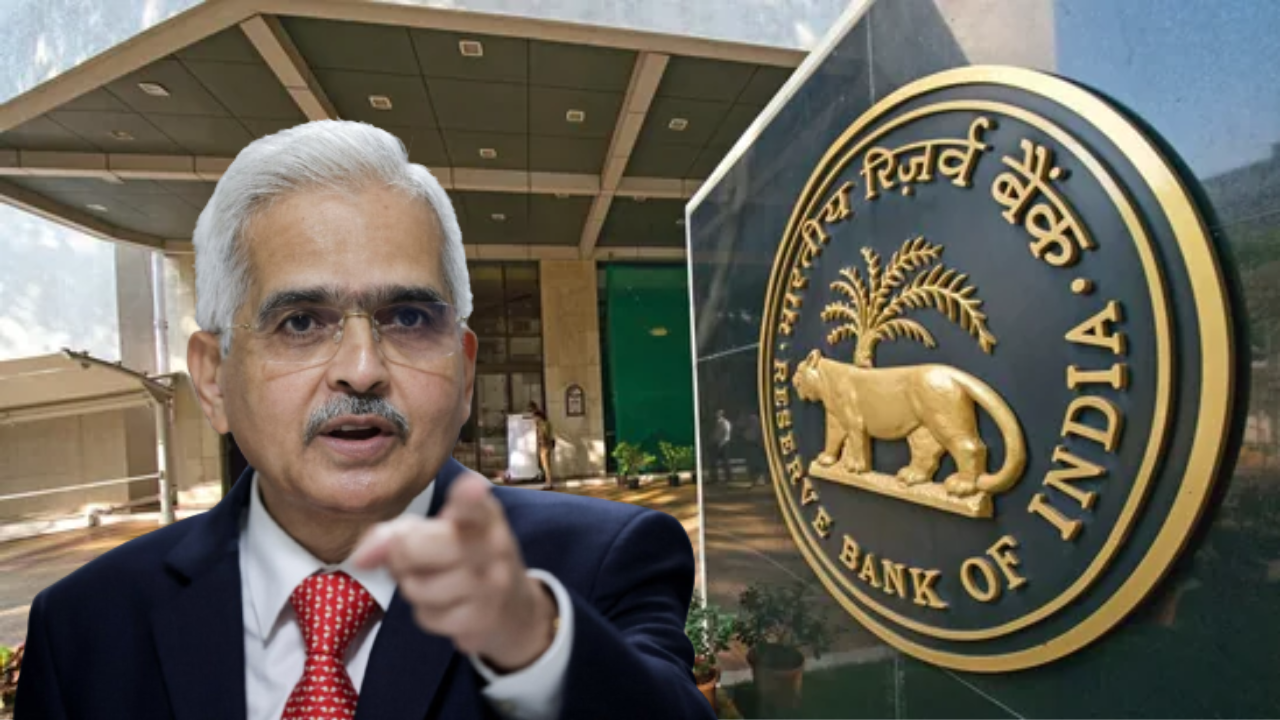

RBI Repo Rate : MPC maintained the repo rate at 6.5 percent, RBI Governor announced a Strong monetary policy.

RBI MPC Meeting Updates Announcement Today: Giving information about the decisions taken in the MPC meeting, the RBI Governor said that the Indian economy continues to grow due to domestic demand. Reduction in input costs has strengthened the manufacturing sector. The pace of investment has increased due to government spending.

RBI MPC has once again kept the repo rate unchanged at 6.5 percent. After the MPC meeting, the RBI Governor said that the Indian economy has shown strength even in the environment of global uncertainty. The balance sheets of banks have shown strength. The MPC of the central bank has kept the repo rate unchanged at 6.5 percent. According to the RBI Governor, as a result, the Standing Deposit Facility Rate remains at 6.25% and the Marginal Standing Facility Rate and Bank Rate remain at 6.75%. RBI Governor has estimated GDP growth to be 7 percent in FY24.

The pace of investment increased due to government spending

Giving information about the decisions taken in the MPC meeting, the R B I Governor said that the Indian economy continues to grow due to domestic demand. Reduction in input costs has strengthened the manufacturing sector. The pace of investment has increased due to government spending. The recovery is expected to be better due to growth in agro credit. Five out of six members of the MPC are in favor of withdrawing the accommodative stance. All the members agreed to keep the repo rate stable.

Increase in food prices in November-December is worrying

The RBI Governor said that the increase in food prices in the months of November-December is a cause for concern in terms of inflation. Rural demand is showing improvement. FY 24 CPI is estimated to remain at 5.4 percent. R B I Governor said that R B I is committed to bring the inflation rate to four percent and is making every possible effort.

R B I Governor Shaktikanta Das said that the rise in sugar prices has raised concerns. Apart from this, R B I has also released the inflation estimate. CPI estimate for Q3FY24 remains intact at 5.6%. Whereas the CPI estimate for the first quarter of FY25 has been maintained at 5.2%. The CPI estimate for the third quarter of FY25 has been 4.7 percent.

RBI Repo Rate

MPC meeting started on Wednesday

The three-day bi-monthly Monetary Policy Committee (MPC) meeting of the Reserve Bank began on Wednesday. The R B I usually holds six bi-monthly meetings in a fiscal year, where it deliberates on interest rates, money supply, inflation outlook and various macroeconomic indicators. For the fourth consecutive time, the Monetary Policy Committee had unanimously decided to keep the repo rate unchanged at 6.5 percent in its October review meeting.

What did the RBI Governor say on the banking system?

The R B I Governor said that the cash position in the system is balanced. No need for OMO. He said that the recent steps taken by banks and NBFCs were necessary for financial stability. R B I Governor said that will bring unified regulatory framework for connected lending. He said that he will bring a regulatory framework for web aggregation. He said that the Fintech Repository will be launched by April 2024. The next meeting of the R B I MPC will be held on 6-8 February 2024.

What happened in the last MPC meeting?

In the last four meetings, the Reserve Bank had kept the repo rate unchanged at 6.5 percent. Repo rate is the interest rate at which R B I gives loans to other banks. Reserve Bank Governor Shaktikanta Das had said in the monetary policy review in October that the central bank was concerned and had described high inflation as a major risk to macroeconomic stability and sustainable growth.

R B Ihttps://x.com/RBI?t=mbGiPl7ADi_YZkzENjyejQ&s=09

Also see. https://mixbrief.com/top10-best-hindi-comedy-web-series/…